Overview

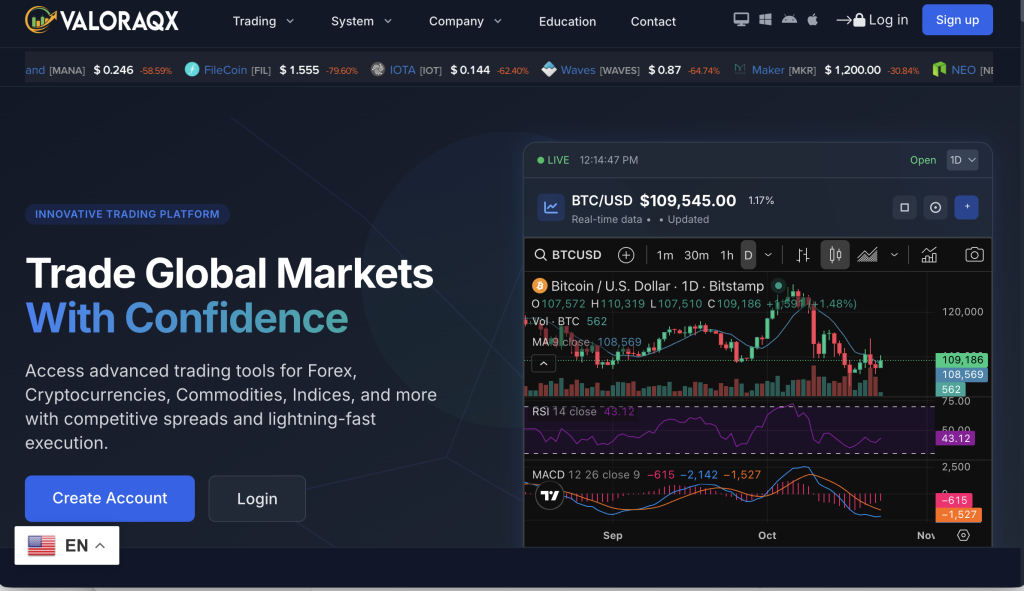

ValoraQX presents itself as an online trading or investing platform promising access to attractive opportunities and modern tools. At first glance, the site’s messaging emphasizes convenience, rapid account setup, and strong profit potential. However, a closer look reveals multiple warning signs that prospective users should evaluate carefully before sharing personal information or funds. This review examines the platform’s claims, checks for transparency and accountability, highlights patterns commonly associated with high-risk websites, and offers an inclusive, plain-language checklist to help readers make informed decisions.

Quick take: ValoraQX uses marketing language that suggests quick profits without providing proportionate transparency about ownership, licensing, fees, or safeguards. That imbalance alone warrants careful scrutiny.

What ValoraQX Claims to Offer

ValoraQX positions itself as a modern gateway to financial markets. Typical claims and themes include:

Easy access to trading or investment products through a user-friendly interface.

Attractive returns and language implying above-average performance.

Support and guidance, suggesting that even first-time users can navigate complex markets.

Low barriers to entry with fast registration and deposits.

None of these claims are unique in the trading world; reputable firms also promise accessibility. The difference is whether a platform balances marketing with verifiable facts—who runs it, how it’s regulated, where client funds are held, and how users can safely exit (withdraw).

First Impressions: Branding vs. Substance

Professional visuals can create an early sense of credibility. Yet true reliability depends on verifiable details. When reviewing ValoraQX:

About/Company details: Look for a registered legal entity name, company number, and the country of incorporation. Strong platforms clearly identify their leadership team and the board’s experience. If this information is vague or missing, that’s a red flag.

Regulatory footprint: Reputable brokers typically publish license numbers and supervisors (for example, a national financial regulator). If the site mentions “regulated” status but provides no official license ID or the named authority doesn’t match the services offered, caution is advised.

Contact transparency: A complete physical address, working business phone line, and professional email domain increase accountability. If contact routes are limited to chat boxes or generic emails, withdrawals and dispute resolution may become difficult.

Licensing and Compliance: Why It Matters

Any platform that offers leveraged products, forex, or securities trading to the public is usually subject to licensing in the jurisdiction(s) where it operates or where it targets clients. Proper authorization matters because it can affect:

Client fund segregation: Whether customer funds are held in safeguarded accounts.

Dispute pathways: Which consumer or financial ombuds services are available.

Disclosure standards: Required clarity on fees, risks, and conflicts of interest.

If ValoraQX does not publish a license number you can independently verify on an official regulator’s register, treat all risk and return claims as marketing—nothing more. The absence of transparent licensing is not proof of wrongdoing, but it is a serious risk indicator.

Product Promises vs. Risk Disclosure

Platforms that emphasize “guaranteed,” “risk-free,” or “fixed return” language without balanced risk disclosure step into problematic territory. Markets move both up and down. Responsible providers include clear risk statements and avoid implying certainty of profit.

When reading ValoraQX’s pages, ask:

Are risk warnings visible and specific to the products offered?

Are fees (spreads, commissions, swaps, overnight financing, account maintenance, withdrawal fees) explained in plain language with examples?

Are terms and conditions easy to find and free of ambiguous, one-sided clauses?

If answers are unclear, reconsider sharing sensitive data or funds.

Onboarding, Deposits, and KYC

A typical pattern in high-risk platforms involves a quick onboarding funnel:

Lead capture: A short form requests name, phone, and email.

Urgency cues: Prompts to deposit quickly to “activate” benefits.

KYC after deposits: Legitimate firms complete Know-Your-Customer verification before funds are used or traded, not after withdrawals are requested.

If ValoraQX encourages deposits before comprehensive verification—or if verification seems to become unexpectedly stringent at withdrawal time—that imbalance is a red flag.

Withdrawals: The Most Important Test

A consistent pattern users report across questionable platforms involves withdrawal friction, including:

Sudden “tax” or “unlock” fees demanded before releasing funds.

Requests for additional deposits to “upgrade” an account for withdrawal eligibility.

Long delays with shifting explanations from support.

A legitimate provider will not require extra, off-platform payments to process withdrawals. Withdrawal terms should be spelled out in the client agreement and follow the same funding rails used for deposits, subject to reasonable anti-fraud checks.

Web Footprint and Content Signals

When evaluating ValoraQX’s website content, look for:

Originality: Copy-pasted wording across multiple pages, stock images with mismatched branding, or recycled blog posts can signal a quick-build site rather than an established operation.

Consistent naming: The legal entity’s name should match the brand across terms, privacy policy, and footer.

Date transparency: Clear publication and update dates for legal documents, policies, and platform updates.

Lack of clarity in these areas can indicate a low-effort or short-lived web presence.

Support Experience and Communication Style

Support quality is often the first lived experience users have with a platform:

Responsiveness: Are replies timely, consistent, and professional?

Clarity: Do responses answer specific questions about fees, regulation, and withdrawals?

Pressure cues: Overly persistent outreach urging larger deposits or “limited-time” opportunities is a negative sign.

If ValoraQX’s support prioritizes deposits and upgrades over documented answers, consider stepping back.

Bonuses, Managed Accounts, and “Guided” Trading

Some high-risk websites use incentives that sound attractive but come with hidden strings:

Deposit bonuses that lock funds behind unrealistic turnover requirements.

“Managed” accounts where a representative “trades for you.” In many regulated jurisdictions, discretionary management requires additional licensing and disclosures.

Referral/affiliate pushes that reward bringing in new depositors rather than rewarding actual trading success.

If bonuses or “managed” features appear without transparent terms and regulatory backing, the risk profile increases.

Security and Data Protection

Trustworthy platforms demonstrate robust security practices:

HTTPS and certificate validity across all pages, especially dashboards and payment forms.

Two-factor authentication (2FA) for account protection.

Privacy policy alignment with data protection laws applicable to the users they target.

If ValoraQX offers only baseline security, lacks optional 2FA, or provides a generic privacy policy, think carefully about sharing identity documents or card details.

Patterns Commonly Seen in High-Risk Platforms

While each site is different, recurring patterns include:

Heavy profit-centric marketing with minimal evidence of audited performance.

Ambiguous corporate identity and cross-border addresses that are hard to verify.

Aggressive deposit prompts paired with weak pre-deposit disclosures.

Withdrawal hurdles that shift the burden onto the user.

Terms & Conditions with one-sided clauses (e.g., broad rights to freeze accounts).

If several of these patterns appear together on ValoraQX, that combination should be treated as a serious warning sign.

Inclusive, Plain-Language Due Diligence Checklist

To help everyone—new and experienced readers alike—evaluate platforms consistently, use this short, accessible checklist:

Who runs it? Find the legal entity name, registration number, and leadership team.

Who regulates it? Look up licenses on official regulator registers and confirm they cover the exact services offered in your country.

How are funds handled? Check for segregated accounts, reputable payment processors, and clear withdrawal timelines.

What are the fees? Identify spreads, commissions, overnight costs, inactivity fees, and any withdrawal fees beforedepositing.

How transparent are the terms? Read the Terms, Risk Disclosure, and Bonus Policy; avoid vague or one-sided clauses.

Can you test withdrawals small-scale? If you proceed at all, start with minimal funds and verify withdrawal speed early.

Is support helpful? Ask direct questions about regulation, fees, and withdrawals. Evaluate the clarity and professionalism of the answers.

Is your data protected? Enable 2FA if available and consider what documents you’re comfortable sharing.

Balanced Conclusion

ValoraQX markets ease of access and compelling opportunities, but the value of any platform rests on transparency, regulation, and a clean, testable withdrawal track record. Where information is incomplete, ambiguous, or unverifiable, risk rises sharply. None of the red flags discussed above prove intent; however, taken together they form a cautionary picture that prospective users should weigh carefully.

If you are comparing providers, favor platforms that:

Display verifiable licenses tied to your jurisdiction.

Publish clear fee tables and realistic risk disclosures.

Offer responsive, accountable support via multiple channels.

Demonstrate smooth, documented withdrawals that users can test on a small scale.

Bottom line: Until ValoraQX demonstrates transparent licensing, clear fee structures, and a dependable withdrawal process that users can verify, it should be approached with heightened caution. Making informed, deliberate choices—grounded in verifiable details rather than promises—remains the best way to protect your time, data, and money.

How GainRecoup.com Helps Victims of Valoraqx.com

GainRecoup.com investigates valoraqx.com transactions, gathers evidence, and maps payment paths. Our recovery team liaises with banks, card networks, and exchanges, files chargebacks, and escalates complaints to relevant authorities. You’ll receive a tailored action plan, clear documentation, and persistent follow-up designed to maximize fund recovery and hold valoraqx.com accountable for victims.